The analyst firm Infonetics came out with a report this week on the Broadband CPE market. CPE stands for customer premises equipment and refers to the home devices attached to a broadband network – everything from modems, to set-tops, and lately new gadgets like femtocells and a variety of home management controllers. Jeff Heynen, author of the report, sees short-term, recession-driven declines in the market, but also projects longer-term growth. I interviewed Jeff for a more detailed account of what types of gadgets he things we’ll see from cable and telco providers over the next several years. Here’s what he had to say.

Interview with Jeff Heynen, Directing Analyst, Infonetics Research

Q. One of the things you mention in your report is that you think we’ll see growth in broadband connections from 2010 to 2013 to support “converged” services – “voice, video, and high-speed Internet now, and home monitoring and automation services later.” What kinds of products do you think will support these services? Will we see more devices like the Verizon Hub and the AT&T HomeManager? They don’t seem to be getting much traction now.

A. Those two products are very early concepts for how home communications systems might work. The traction for those products is bad for any number of reasons, including macroeconomic conditions, their price points, and a general confusion among subscribers as to their utility. I really think both providers missed out on integrating some femtocell capabilities in those devices, rather than introducing separate femtocell gateways with yet another recurring fee. Why not combine the two, increase mobile reception in the home, while providing a low-cost, high-featured VoIP line to increase ARPU on a fixed broadband connection?

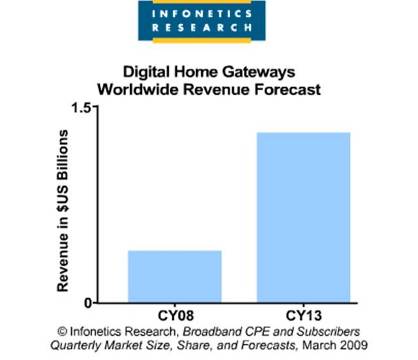

In the short-term, we really see growth in digital home gateways, which combine a modem, gateway, IAD (EMTA), and some type of home networking function (MoCA, HPNA, G.hn, etc.). Operators will be able to monitor these devices and their performance remotely and effectively move their sphere of influence into the home to ensure the stable performance of all their services, especially video.

Q. With potential growth in home monitoring and automation services, do you think we’ll see more supporting products (like cameras and home controllers) come to market through retail, through service providers, or through a hybrid retail-product-bundled-with-service model?

A. I think the hybrid approach, where operators distribute their own systems, but also have their own areas within retail stores, selling bundled packages is the likeliest scenario.