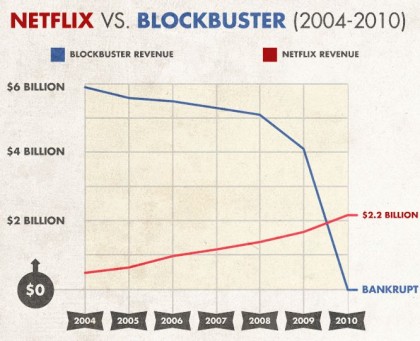

Online MBA Programs (who?) has compiled a variety of stats into compelling series of graphics that document “How Netflix Destroyed Blockbuster.” While the inverse parallels are dramatic and it’s worth perusing, I remain convinced that Blockbuster is fully responsible for their downward spiral.

Many have pointed to Blockbuster’s missed opportunity of acquiring Netflix on the cheap a decade ago, but the end result would have have likely remained the same given their leadership and vision. And an inability to execute.

Take for example, Blockbuster’s failed forays beyond the brick & mortar. They launched their own mail order DVD service and acquired Movielink for online video. Which saw little uptake and questionable management commitment. Then there was that poor video streaming box that they failed to market (or update) and then quickly buried. Blockbuster had a significant evolutionary opportunity to take on Redbox in the DVD rental kiosk market given their brand. But they were late to that party too and largely licensed away their advantage to NCR.

As a product of the 80s, I witnessed first hand Blockbuster’s decimation of the small video retailer and suffered through more than my fair share of long lines and surly customer service. Not to mention BBI’s late uptake of DVDs which, incidentally, is when I began my defection from the their hegemony. So, while I feel for folks let go as Blockbuster rightfully implodes, I feel no remorse in relation to the brand’s failure.

I have no idea what the future holds for Blockbuster. In fact, the consortium of debtholders that’s agreed to purchase the remains (for a mere $290 million) doesn’t seem to either. In fact, beyond Chapter 11, one option on the table: complete liquidation.

(via New York Times)

I fully believe that Blockbuster is responsible for their own downfall. Sure Netflix and other services had a ton to do with it, but look how they treated their customers with late fees, pricing and other trickery. They screwed me more then once. I can’t even remember the last time I went to a Blockbuster.

Then, there was that inability to grasp the Online streaming thing like Netflix did and ran with it.

I say good riddance to bad rubbish. May Netflix reign and not fall like Blockbuster has and still will.

I’m willing to bet the slow demise of Blockbuster is due in large part to lack of customer loyalty. For years, they were the only kid on the block and took huge advantage of their customers with shady pricing and charges (high late fees, rewind fees and charging your credit card full price after a week to name a few).

When NetFlix came along I bailed in a heart beat and no service of equal value from Blockbuster would have ever brought me back…

Blockbuster had $0 revenue in 2010?? Anyway, I suspect Redbox had as much to do with Blockbuster’s rapid fall over the last few years as Netflix did. Redbox directly challenged Blockbuster’s physical presence — stores and kiosks accounted for 55% of the rental market in 2009 (http://www.rentersinsurance.org/netflix-redbox/) which was Blockbuster’s strength. Also note the revenue growth of Redbox’s parent Coinstar (http://www.seattlebusinessmag.com/article/redbox-coinstar%E2%80%99s-red-hot-growth-machine).

Dave, I probably received the same email that you did, from a “Kate Becklys”, with a link to the Netflix vs. Blockbuster infographic. Something didn’t smell right, so I replied and asked her who she worked for, and on whose behalf she had sent me the link. She never responded, and I didn’t run with it. I’m glad that you didn’t run the entire infographic.

At this point Blockbuster is all but a dead asset with only its “brand” as the remaining value and even that is tarnished. There is nothing that Blockbuster has that a startup couldn’t replicate very very quickly. And that’s the whole point. Blockbuster was just too slow to react and cannibalize its own cash cow. And now the cow is deal.

The graph is really incomplete without showing other streaming services, cable on demand revenue, and premium channel on demand, which pretty much all hit prime time around 2004. I’d be curious as to the total market size for home movie consumption and the Blockbusters diminishing share. It’s due in large part to the shift to digital consumption. But the advent of $20 DVDs further killed the physical rental market.

The most amazing thing really is that Netflix managed to gain so much traction so quickly with the mail order DVD strategy AND that they were able to ‘pivot’ into the digital streaming.

Nice article. Blockbuster did it to themselves and it has been a death of a thousand cuts. No single bad move or decision is responsible for their current situation. They consistently make the wong decisions and have very poor management guiding the company.

Len, yeah it’s a somewhat odd place to generate and host this. I suspect it has something to do with gaming Google. But I caught it on the NYTimes, maybe via a tweet?

Andy, yeah the more interesting story is Netflix’s success and ongoing transition. Good timing, even better execution.

Dave, thanks for clarifying where it came from! I was very suspicious of the “Online MBA” link, and the email I received was from a Gmail account with no signature or other information about the sender. It could have come from anything from a content farm to a short-seller.

to andy,

wouldnt you say they still have an asset that isnt widely talked about; their deals with hollywood. hollywood doesnt like netflix and redbox but they do like blockbuster. any thoughts on this?

cheers

adam, not anymore?

Studios Fight Blockbuster for Millions in Unpaid Fees

“I fully believe that Blockbuster is responsible for their own downfall. Sure Netflix and other services had a ton to do with it, but look how they treated their customers with late fees, pricing and other trickery. They screwed me more then once.”

I feel your pain. But your argument is insane.

Blockbuster is responsible for their own downfall in that they chose to be in the business of retail store distribution of Mechanically Reproducible Arts. All of those businesses went belly up. Books, movies, music, whatever.

Blockbuster is responsible for their own downfall in that they didn’t they didn’t leverage their brand to expand into the business of electronic distribution of Digitally Reproducible Arts, when everyone saw the mechanical/digital revolution coming a mile away.

In short, it’s about something interesting, but it ain’t about Blockbuster’s customer service.

dave,

i had read that article, you make a valid point. the only issue i see with those fees is they have to do with actual inventory; the dvds. would you agree once a new suitor has liquidated most of their stores and dont have to worry about that type of overhead, their main strategy will be streaming. eliminating all those potential charges.

adam,

The world is different and there’s minimal need for a dedicated retail outpost to serve up physical media. All they really have is their brand (and whatever remaining inventory and real estate/leases?). Possibly their biggest blunder was licensing their brand to someone else’s kiosks, which is where I thought they were best suited to go. Not sure there’s room for them online at this point – given the large number of established players. Maybe the company that bought “Circuit City” and “CompUSA” will know what to do with the name “Blockbuster.” I wouldn’t mind a cinema draft house renaissance or maybe some new line of microwave popcorn.

totally agree but one question that you may or may not know is, what is carl icahns role in all of this. selling his shares to buy back secured debt. have you read any articles about the conspiracy of carl and ceo keyes.

so a couple scenarios i see.

1. the stalking horse bid is the winner; they liquidate everything and blockbuster is no more. they basically try to recoup any losses and hope to come out with some cash

2. carl steps in and wins the auction for what ever amount. he finished liquidating as many stores as possible (think in their chap 11 filing they were hoping to get it down to around 100 stores). he concentrates on the online streaming side of business and starts competing against the big boys again. the stock skyrockets and is once again traded on the nyse.

3. a competitor steps in and wins the auction. 2 things could happen here. one they keep blockbuster a separate entity and trading under the same ticker. or they totally get rid of the blockbuster brand.

any thoughts

I don’t cover tech from an investment standpoint, other than mentioning the bankruptcy. So I offer no suggestions on whom ends up with the property and/or a potential relisting. But I think it’s quite possible that whomever does end up with the property next makes an online play, and they’ve already got a bit of a start on some platforms (like TiVo). If I were the debtholders, I’d liquidate property and resell the brand/name to someone else’s project. Maybe Walmart would like to rename Vudu Blockbuster and operate online and instore.

I’m such an outlier.

I still get value from my Blockbuster Online subscription. If you want a good selection of Blu-ray disks, Blockbuster is still the better option. The stores aren’t all gone yet, and when you combine the ability for in-store exchanges at no additional charge, I think it is a good program.

The quality of what you get with streaming just isn’t there for me yet. Still too many movies without 5.1 (or better) sound, for example.

But, sadly, it seems me and the other fans of Blockbuster Online could fit inside one of their closed physical outlets.

“The stores aren’t all gone yet”

Depends where you are… my three closest stores when I was in Maryland (1.5 years ago) had all closed. In Virginia, the only convenient store closed 1 or 2 months ago. In fact, the photo above was the trash bin used to empty it. I tried to grab a souvenir, but there was nothing worthwhile.

I think it’s interesting that the combined area under the curves has fallen to drastically over time.

Infographics are becoming a pretty common keyword spamming technique. See this infographics on how spammers are using infographics in an attempt to game search engines: http://www.buzzfeed.com/awesomer/the-truth-about-infographics

Brian, thanks for the confirmation and clarification. It’s a tricky thing – I do want to credit them for producing the graphic and this is a relevant topic for discussion here. But they obviously have an ulterior motive. Hmm.

like i care blockbuster is out business charging movies over 5 dollars its two much at least 3 dollars be ok blue ray too its just redikolus its rip off ever since netflix came changed everything unless they learned their mistake change rental 3 2 dollars cheaper costumers be back rental just like netflix 4.99 rental its really out off control no buddy want rent movies that expencive you can buy buy meal with that price if they learn they mistakes loosing business changing prices rental just like netflix every costumer be happy just like old times vide family never get price up sometimes you got latefees but they dont force you pay pay at least dollar whatever you feel like every boddy is happy i love video familys and netflix every boddy wants save money if they charge cheaper movies youre business be fine if you charge over 5 dollars you lose costumers of corse plus netflix 8.99 a month i would if you learn youre mistake change price down we fergive you if you not you did youre self

Re: JohnO – I’m a fellow outlier… I still have a 3 disc at a time by mail, unlimited in-store exchanges, PLUS two coupons per month account… for $17.99/mo. I got grandfathered in when they raised the price of that to, ahem… $35/mo. The value I get living close to one of the few operating stores in terms of being able to rent blu-rays, video games with the coupons and just being able to browse actual DVD cases and get out of the house trumps Netflix. For them, I only have the streaming option. Lots of great stuff on there if you’re a true cinephile, but I think it offers very little if you’re Joe Schmoe average moviegoer who wants to see the latest movies. For that, Blockbuster was idiotic to let Redbox (and I believe the guy who started that company first offered the idea up to BB, didn’t he?) muscle in and claim nearly 100% of that territory first.

A good model for Blockbuster would have been to make a deal for the kiosks at any cost with convenience stores, wal-mart, mcdonalds, etc., keep their mail-in customers by including some kind of kiosk offer (scan your card there, get a certain # of releases from the kiosk per month), and let each franchisee CLAIM a percentage of the revenue from their nearest kiosks. Divide up the territory and conquer. As for streaming, they should have paid through-the-nose for ONLY new content, not library content, and I think the one-two punch of these measures would have at least given them parity with netflix. But they failed in every conceivable way… always late to the game. Sure they would have hemorrhaged money in the short term, but it would given them an edge in multiple areas, perhaps enough to stay alive.