Quarterly Subscriber Change, TVbytheNumbers

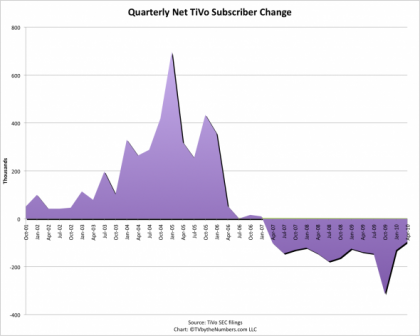

TiVo held their quarterly call yesterday and, at first glance, I’m not seeing any surprises. Subscriber count continues to decline, from 3.2 million a year ago to 2.5m as of 4/30. But TiVo’s got plenty of cash in the bank (~$250m) and zero debt, along with a number of lawsuits and partnerships in various stages of development. Speaking of which, Cox, Comcast, and DirecTV are merely sputtering along, whereas RCN is deploying the TiVo Premiere (with On Demand!) at a rapid pace. The relevant docs:

My writing partner Davis Freeberg follows TiVo closer than most, as a customer and an optimistic investor, and covered TiVo’s call on FriendFeed in real-time yesterday. His unedited stream:

- Warning spoiler alerts.

- Analysts are bearish for TiVo going into the results predicting that they will lose .16 cents a share and that revenue will be down 12% at $43 million

- TiVo released news ahead of their results this morning about building Non-DVR TiVo software directly into Insignia TVs. I’m hoping that we’ll get more information about the economics of the deal (is it exclusive, is is a per user royalty, etc.) as well as more info on how it might actually work. If this can be used as a TiVo streaming device, this TV may find it’s way into the homes of many current TiVo owners.

- I also expect that we’ll hear some information about TiVo’s patent battle with Dish, although there won’t be much that they can say about the en banc review. Most importantly, I will be looking for language that will help clue us off as to whether or not there is any price that Dish can pay to make TiVo settle. Whether TiVo tries to extract money from Dish or uses their ability to exclude them from having a DVR at all will say a lot about where their focus is and how they’ll drive the company forward.

- The numbers are out

- Tech revenue came in at $43.2 million, but net revenue was 61.4. The net loss of $14.2 million represents .13 cents a share.

- Interestingly enough, this qtr. was the first time in their history that they made money on the hardware. I guess the TiVo premieres are priced at a sweet spot for them.

- What they don’t make very clear in their press release is that they lost another 100,000 subscribers in the quarter and now have just 2.5 million subs.

- Avg. revenue per TiVo owned subscriber is $7.54. For MSO owned sub it’s $1.12. This is exactly the reason why they shouldn’t take a settlement for Dish and should instead use the lawsuit as bargaining power with the other MSOs.

- Tom Rogers is starting the call by addressing the en banc decision. He says it’s important to note that the en banc review doesn’t address TiVo’s patent, as much as seeks to clarify patent law. Basically what should happen when someone gets an injunction, but then someone says we changed our product so it doesn’t infringe. Should Dish be able to force TiVo to keep suing over and over again or should a trial judge have the ability to issue broad injunctions?

- Rogers says that if the En Banc goes against TiVo it will weaken the patent system and make the victims pay for enforcement.

- Balance sheet grew by $11 million cash in the qtr. now over a quarter of a billion. – Davis Freeberg

- Rogers says that they are seeing “increased interest” in operators for the TiVo premiere interface. He’s used this phrase before, so I wouldn’t pin any hopes on it.

- RCN’s distribution is how TiVo would like to do it with everyone. They are hoping to use it as an ideal blueprint for how TiVo could rollout quickly.

- TiVo is one of only a couple solutions for bringing linear tv (broadcast, cable, etc.) with internet content.

- Over the quarter TiVo announced a deal with Technicolor who is the #3 set top box user. It will let TiVo port directly to their box so international operators can license TiVo. They are in discussions w/ mulitple operators and hope to have more to share this year. The Technicolor deal could really end up opening up Europe to TiVo.

- Stand alone broadband boxes can’t record tv

- The TiVo Premiere is a more cost efficient box than previous models, so they generated a positive net hardware margins. They are hoping to augment the box with software updates over the next month?s?

- If TiVo is turning a profit on the premieres it would go a long way towards solving a problem for them. For years, they’ve subsidized the box in exchange for the service revenue, but hopefully this means that they can start to have their cake and eat it too.

- They continue to make partners in the audience measurement space, but Rogers doesn’t address the subscriber attrition. TiVo has a lot of potential to be a huge player in the ad biz, but not with 1.5 million subs. What do they need to do in order to fast forward their sub growth again?

- TiVo is getting over $100k per month from the interest on $250 million in cash, if they invested in that in some Dish bonds, they could get their income up to $1 million ;)

- We are still waiting for DTV and Virgin to go live before sub growth resumes. I wish we had a better understanding of why it takes so long to go from announcement to realization and better clarity on what our expectations should actually be.

- Woo-hoo, R&D spending is up, new toys to play with.

- They hope that “additional investments” in coming years will create growth, does this mean that TiVo has decided against paying a Dish dividend or doing a share buy back in lieu of being a growth company through acquisitions?

- Q&A time

- Comcast still hasn’t rolled out of Boston, Rogers says that it’s very important that RCN rolled out as quick as it did. Now that they have a real product to show the cable industry, it gives them “one more path” to talk to the industry.

- Tru2way still has question marks, as a result of that TiVo is looking for alternative way to bring TiVo to an MSOs. Big question in the room is why hasn’t Comcast adopted the premiere strategy if tru2way is vaporware.

- Analyst is asking a question about how many premiere boxes have sold . . . the 1st qtr isn’t much of an indication of sales because 2/3rds of the qtr it wasn’t available. They are focused more on fall when they’ll spend more on marketing to take advantage of the TV season. IHe says that it continues to be something existing subscribers are upgrading to, but doesn’t define what that is.

- GoogleTV is a real contrast compared to premiere. TiVo is a one box solution, GoogleTV won’t be able to address linear programming. Consumers want Hulu and that’s the only piece TiVo is missing. Real ? about whether or not GoogleTV will be able to do what other TV software providers haven’t

- Analyst is asking why the appeals court is picking on TiVo – Rogers doesn’t have any insight on why. It’s only about a 3% chance of being accepted. From what I understand 75% of the cases they take end up being modified in one way or another. – Rogers says that the bottom line on the case is that it’s about how much time should it take for an infringer to get justice. If you have an aggressive offender (cough: Dish), it could take 10 years to be able to get an injunction.

- The DTV deal kicked in on Feb. 15th (meaning that they are getting cash each months from DTV), but until they have a product they can’t start to recognize it.

- An analyst just asked if, from a technical perspective, you could put a “browser” in TiVo that would let you go to Hulu? – Rogers says that the idea could be done, but there are ways that content providers could defeat for purposes of display. It comes down to whether or not Google could do it without a deal.

- An analyst is trying to trick Rogers into talking about what the worst case scenario with Dish could be, but he isn’t falling for it. It’s like when a prosecutor asks someone to hold a knife and then proceeds to tell the jury about how awful a slashing was. Psychologically it shows weakness.

- AT&T and Verizon continue to move along.

- I just don’t understand why the analysts are so in love with GoogleTV.

- The call just ended, thanks everybody for tuning in

Looks like they’re following the path of Palm.

I like my TiVo HD but it really looks like they are lost/drifting..

Perhaps if TiVo put more energy into their products, they would be doing better. I was a TiVo user for 11 years (1999-2010). I purchased 3 TiVo Premieres as upgrades to my older TiVos. They were a disaster… slow, crashes, reboots. I returned them and will be cancelling all my TiVo service in favor of MOXI.

Ah Tivo :-(

TiVo thinking that the cost thing is working out for the Premier is a bit off (it costs less to make, but they’re still charging $300 for it). Everyone seems to be passing on TiVo and going for some cable DVR… which costs more per month, does less, and functions poorly… all because they think TiVo is too expensive.

$300 plus a monthly cost is a hard sell.

Tivo seems to be less relevant than they were in years past. The UI is great, but their hardware lags far behind. I’m not even tempted to buy a Premiere.

how is this for brain dead: Tivo still hasn’t figured an easy way to migrate your settings to a new box. All they care about is your monthly fee. Do they know if they actually made a better box people would buy it too?

the profit margins on each box must be amazing. I mean, until the premiere we are talking about 10 year old technology. How much is a HDTV tuner? $25? hard drive: $50. chipset: 25?

@Charlie

I totally agree, it’s such a pain every time I get a new one. I have to spend 4 months remembering to re-enter all the shows.

Totally agree, why can’t they back up preferences in the cloud? Lame!

Anyhow, if they have all that cash, they should hire more engineers and brings updates/new products to market faster! It’s not like there’s a cable operator in between them and their [native] boxes… Love TiVo, but :(

Yup, sad to see them sag like this. Still holding out hope the Tivo Premiere will simply become an adequate replacement for the Tivo HD at some point, with better network performance. A few tweaks like streaming protected shows would get me onboard at some point. Not enough to dig them out of the hole they’re in though.

Honestly, they need to get Google to buy them. Or something.

I think the comparison with Palm is the right one. Just dying a slow death here.

Maybe Microsoft will get Windows Media Center Embedded built into a suitably cheap hardware platform and RVU TVs will make remote access to a whole home DVR easier. At which point I’ll just toss all the Tivos out. Seems like that’s a couple of years away though, so they’ve still got a chance.

The song remains the same.

TiVo is the absolute worst DVR in the world except for all the other DVR’s…

Chucky, I would definitely recommend checking out MOXI. It has a great interface (although a bit slow at times) and awesome network features and performance. You can stream live and recorded TV from any DVR to any other MOXI device. They have DVRs with 3 tuners and STBs called MOXI Mates that stream content from the MOXI DVRs. No monthly fee either.

Well… I’ve got both in my house.

The streaming Moxi extender solution is not perfect, but handily beats TiVo’s MRV limitations/implementation (in overcoming the CCI Byte record once issue). The Moxi GUI is overly cluttered and along with the remote, not quite as intuitive as TiVo. However, given the slowness of TiVo’s HDUI it could be a wash in that department for a geeky user. But my wife is much more comfortable in the TiVo UI, for example. A bigger killer for me is no Moxi HD VOD service, as that’s our primary movie rental model these days. I know they were working some sort of SD solution out with CinemaNow, but that initiative may have stalled.

wow – time and again people call the death of TiVo and yet again TiVo is chuggiing along with tons of cash and no debt. They could go many more years just on the cash on hand.

So the new CEO seems to have gotten a handle on product costs and making good deals like RCN – now he needs to start taking on the problem of growth – as in it is negative :) Still he has many more years to do that :)

PS – to those who had problems of slow HDUI on premiere – there have been very recent updates that are fixing those problems – specifically getting images off the web to create the discovery bar and so forth

Zeo, I have the 14.4 update. It’s still way too slow in a number of ways. :/ I’m not convinced there’s a significant/noticeable change in performance. But that’s just me and I see the posts stating otherwise…

Also I experienced the same bug as Molly Wood (and under 14.4). Actually, Melissa experienced it related to the Idol finale last night and about divorced me. The ‘select’ button doesn’t play recorded shows when an Internet connection is unavailable. HOWEVER, the ‘play’ button will.

I’ve been with Tivo since the beginning. While I don’t think Tivo is going anywhere, I’m out as soon as my Ceton card arrives (in June, or July or…). I think that the RCN partnership is a great move. I hope this is the first step towards other software and hardware partnerships, unlike the Comcast fiasco.

I seriously doubt TiVo is losing money on hardware despite their claims. The “build of materials” for TiVo HD doesn’t approach the $300+ point. Boxee’s STB has far more powerful hardware and sells for the same price ($299). At best, what TiVo charges for hardware doesn’t cover the overall operating expenses. TiVo has not subsidized “Series3” hardware ever.

If TiVo wants to sell MVPDs on the RCN model, future hardware will need to include a DOCSIS modem. Without it, Premiere hardware is a non-starter for Cable MSOs.

“The streaming Moxi extender solution is not perfect, but handily beats TiVo’s MRV limitations/implementation (in overcoming the CCI Byte record once issue).”

A non-issue with the TiVo as long as FIOS is involved, of course.

“However, given the slowness of TiVo’s HDUI it could be a wash in that department for a geeky user. But my wife is much more comfortable in the TiVo UI, for example.”

I continue to assert that any Premiere owner running the new UI has at least minor sanity issues. The classic UI is old, but the damn things just works.

I’m with your wife. I’d still run the classic UI on a Premiere even if the new UI ran like the wind. I like my UI’s uncluttered and unbusy. It’s the only way for a UI to disappear in routine usage.

Running the new UI at least part time is kinda like a job requirement ’round these parts. ;)

Off-topic, but Engadget get the scoop of the day.

If the scoop is true, they’ll sell ’em like hotcakes at that price level. They’ll have 50%+ of the “second STB market” in a year.

My only question is whether it’ll play your non-AppleStore purchased mp3 and mp4 media stored on the LAN. Given the way iTunes handles home sharing (AppleStore purchased media only), my initial guess is no. But we’ll see how compelling a solution Apple wants to make this for enthusiasts.

No surprise on going with an iPhone/iPad model (sales and hardware)… mostly just a question of when. As I said last month:

Apple’s got a proven app store business model. As soon as they migrate it to the Apple TV, they’ll simultaneously stimulate development and sales. And, of course, they’ll take their cut of app revenue. We’ve already got a number of decent video-centric iPhone apps that could work well in a lean-back environment, such as Showtime, Slingbox, and Netflix. However, significant work would need to be done to support the various resolutions, aspect ratios, and entirely different form of (remote) interaction.

Of course, without support for network or premium TV, it’ll still be a secondary television device as opposed to our DVRs. But would probably easily crush most of the competition given their cachet and existing ecosystem. Popbox who?

If Apple tossed a ATSC or QAM tuner in there, TiVo’s days would easily be numbered. Apple might even have the cache to convince MVPDs to offer a slate of “Clear QAM” channels.

TiVo exists because it has no real challengers in the retail space. More importantly, it lives off its DVR patents. TiVo’s software engineering sucks IMO, and their DVR absolutely rots as a “media extender”. There’s no reason TiVo’s DVR should make uploading AVC or VC-1 shows to the DVR (with metadata) without transcoding.

Oh well. It’s a business decision I’ll have to respect. The fact I won’t purchase further subscriptions nor recommend their product (beyond my existing Series3), is something they probably couldn’t care less about.

Make uploading shows so difficult.

“The fact I won’t purchase further subscriptions nor recommend their product (beyond my existing Series3), is something they probably couldn’t care less about.”

Buy a one of the refurbed TiVo HD or HD XL models they’re currently blowing out at bargain basement prices. You’ll be happy you did.